Small Launch

How do you create a competitive small satellite launch business?

- Small launcher value proposition

- Small launch – hype or business?

- Ride share is the only real cost benchmark

- Why is small launch so expensive?

- How do you compete with ride share?

- Rocket engines – how hard could it be?

- Why count 2 stages on a rocket – how about just 1?

Small launcher value proposition

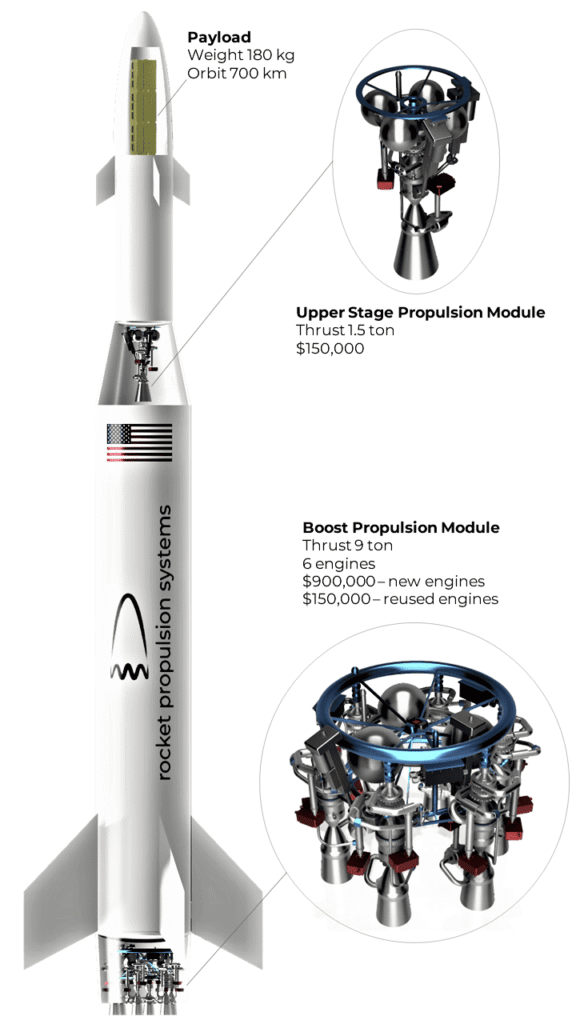

If you are a new small launch startup, consider buying the Centurion engines for your prospective rocket. The engines will be sold at a unit price of $150K each, and are designed to be reliable and reusable. The engines will be developed under the supervision and funding of U.S. National Science Foundation / Space division and will be thoroughly validated in their performance pre-sales. You can stack the Centurion engines like LEGO® blocks on your rocket, just like the aircraft or large semi truck companies do with their engines. The low engine price opens up wide competitive possibilities for your startup to not only enter the small launch market successfully, but also be viable in the long term.

Save time and money

Build a rocket lifting 180 kg to 700 km LEO that costs $1.5-2M to compete with ride share

If the 1st stage engines are reused, the entire rocket could cost even cheaper, approaching $0.5M

Cut rocket development expenditures from $100M/5 years to $20M/2 years

No need to hire the engine development team, which could take at least a year in itself

Small launch – hype or business?

Small satellite launch vehicle market is anticipated to experience a large gap between launch demand and supply, approaching on average 450 unfulfilled space launches per year by 2026. The size of small sats keeps decreasing. We may see tens of thousands small satellites the size of an iPhone in Low Earth Orbit (LEO) of by the end of this decade! Current trend for the majority of small sat providers has been to share ride with large payloads to get to suboptimal orbit and then use on-board microscale thrusters to tug their small sat to the final desired orbit. The small sat constellations currently built have rigid geometries that are shaped to cover Earth surface under observation as evenly as possible, so for an Earth observation service to be profitable, getting each small sat in the constellation to its dedicated orbit is highly desired.

Ride share is the only real cost benchmark

The ride share may cost up to $2.5M and 1 year waiting time in a queue with others wanting to go to space. The follow-on in-space tugging to final orbit may take another 3 months to 1 year. Meanwhile, the small sat provider incurs large operational overhead costs here on the ground simply waiting. To circumvent this waiting, new small launch companies have risen up in recent years that promise space launch straight to dedicated orbit. However, the launch cost on dedicated small launchers may well exceed $10M. For a typical small sat with a weight say of 180 kg, this converts to cost in the range of $35K – $70K per kg. Whereas the ride share would charge $15K/kg or less. Moreover, majority of the new small launch vehicles have not succeeded in their goal in delivering and inserting the payload to LEO. And so the higher cost and lower reliability of small launchers have been tipping the scales for small sat providers to choose the ride share over dedicated launch. The small dedicated launchers are essentially left to serve only a small niche of government missions. To alleviate this problem, some small sat launchers have even gone to the extent of selling their rockets for launch at a price lower than the cost to build them, but that has not helped much in affecting the current balance between ride share and dedicated launch.

Why is small launch so expensive?

After Falcon-1 and Falcon-9 successes, the small launch companies have been emulating the pre-existing model of a tight vertical integration, where the entire rocket is built in one factory, including engines, airframe, avionics, etc. – mostly because they did not know any better. This model presumes that all of these components need to undergo their own R&D testing campaigns that are costly and time consuming. For a typical startup that wants to build a small-sat launcher from scratch following this legacy model, it may take of up to $100M and 5 years from start to first demo flight. 80% of this cost and time can be spent on developing the rocket engines. These expenditures are usually funded by VC/private equity and that drives the need for small launch companies to recoup the investments they received through higher launch cost, which is not competitive with ride share, putting small launch into a much more redundant role than it could otherwise attain, which is not a winning proposition.

How do you compete with ride share?

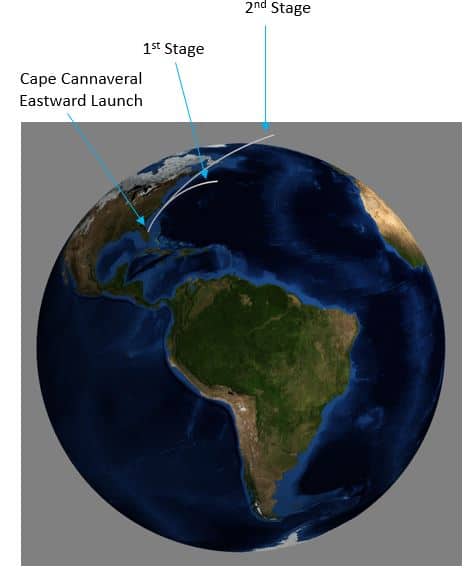

In order to compete with ride share, the dedicated small launch vehicle has to cost $1.5-2M, or less than $15K/kg (and not upwards of $10M that is on offer now). And of the most efficient ways to make it happen is to buy engines from outside.

At least 6 engines are needed on the first stage to make its flight mission fault tolerant to a single engine-out failure. Fewer than 6 engines would drive down the reliability of the rocket, affecting viability of small launch company significantly in the long run. The engines need to be throttleable: throttle up in engine-out scenario and throttle down during potential landing of the 1st stage for reuse. The economy of scale also dictates all engines on the rocket to share common core design to save on development and production infrastructure costs. Assuming a 2-stage rocket, with 6 engines on booster, and 1 engine on upper stage, this converts to an engine price of $150K and not higher. The total propulsion cost of the entire stack in this scenario comes to $150K x 7 = $1.05M. Considering the added costs of other stage/ground systems, range, insurance, etc., we can arrive at a total cost for the entire rocket in that $1.5-2M range. The engines cannot cost $500K, $1M or $3M – prices that are floated by some companies – to make a viable small sat rocket competitive with ride share. Moreover, the engine size has to trend toward smaller thrust levels given the global trend of small sats becoming smaller and smaller.

Rocket engines – how hard could it be?

Rocket engines are really hard – people are starting to realize it now with the emergence of private/new space. Highest risk in any rocket is engine, next highest is the avionics of the engine. Most of recent launch failures in 2022-2023 in the U.S. were associated with engine malfunction. Fundamentally, they should be as easy as car or jet engine that a truck or aircraft builder can buy and install in their vehicle.

The majority of the engine cost is in paying for its development. According to the legacy vertical integration model, most startups want to make their own engine to control cost, but that requires absorbing large development costs. It is best to use government money to develop the engine, but many startups don’t have it. Small players see how hard it is to staff up a good engine development team, which may take at least 1 year on its own. This creates a paradigm shift for them to buy commercial engines instead of developing their own. Even the big players are looking at small players now and trying to buy external propulsion for their large expensive rockets. The time for commercial rocket engines is here.

Why count 2 stages on a rocket – how about just 1?

It takes roughly 8-9 minutes for a space launch vehicle to reach orbit! Loading all of the propellant burnt during that long flight onto a single stage would leave only a tiny room on the rocket for the payload that needs to be in space – less than 5% of the weight of the entire stage in the best case scenario (in which hydrogen is used as the fuel). Any tiny deviation in the as-built vehicle structural mass, engine performance or trajectory deviation during flight may result in payload not delivered to orbit. Rockets are built by people and are never that perfect. DC-X was historically the most prominent example of a single stage to orbit (SSTO) vehicle, which inspired the New Shepard design among others. None of SSTO vehicles ever reached orbit. Unless super-light materials appear on the horizon resulting in vanishing weight of structures like tanks, fluids plumbing, guidance components, etc., not reaching orbit is foreseen to remain the case in the near future. However, if despite these challenges, there was a successful orbital SSTO vehicle, it would most probably be based on hydrogen and exceed the 15K/kg mark in launch cost set by the ride share, which would affect its long-term economic viability. Two stages has been shown to be the minimum number of stages if the launch vehicle is ever going to make it to orbit, because you need to shed the dead weight of the vehicle emptied out of propellant as you’re fighting Earth gravity in your climb to orbit. And that is why we’re using 2 stages in our vehicle cost assumptions, giving rise to two distinct boost and vacuum propulsion modules.